Portfolio update: 2023 annually

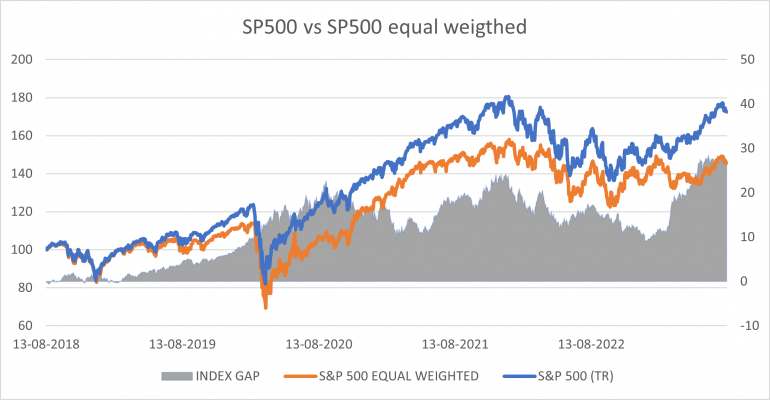

The year is coming to an end, and therefore, it is time to evaluate how the portfolio has performed. The stocks that have provided the greatest returns this year are Fastighets AB Balder, Pandora, and Alphabet Inc (sold). Overall, the portfolio has yielded a significant return of 27,11%, compared to the benchmark. Despite media discussions about the economy heading into a recession and the possibility of war, the stock market showed a year-to-year increase, with a few stocks driving the overall market up.

Your investing strategy is centered on identifying stocks with substantial growth potential and profitability while trading at a low valuation.

Now, let's discuss Fastighets AB Balder (BALD B) as a stock that has been a good investment this year. Since the purchase of the stock in 2023, the stock has returned around 79%, which is a commendable performance, especially considering the average return requirement of 8%. The question arises: is it time to sell the stock? When considering selling a stock, I examine three parameters:

- Is there another investment with greater return potential?

- Have there been fundamental changes in the company?

- Does it constitute too much in the overall portfolio?

Firstly, the stock has experienced a significant increase, surpassing its fundamental value, just as it had fallen more than its fundamental value before. When I initially purchased the stock this year, it was trading at approximately 0.5 times the price-to-book valuation. Currently, the stock is trading at around 1. This suggests that the market doesn't anticipate a significant decrease in the company’s real estate portfolio. While Balder had assets written down or sold at a loss in the previous year due to higher interest rates, the coming year might see a turnaround in asset valuation, potentially lowering the forward price-to-book ratio even further. However, it's crucial to note that Balder operates in a cyclical market, where supply and demand influence asset valuation. If demand diminishes, asset valuations may fall, potentially leading to a domino effect if some real estate companies go bankrupt. Despite these considerations, I believe the stock is traded close to fair value. The presence of co-founder and major shareholder Erik Selin, who is still in charge, instills confidence that he will act in the best interest of shareholders. While I don't expect the stock to provide an extraordinary return, especially if interest rates rise further, I consider it a rational investment given Selin's leadership. However, I believe there may be other stocks with greater potential, although I haven't shared them because I only disclose my choices after purchasing a stock, avoiding any influence on my decision-making process.

Since nothing fundamental has changed, and it doesn't constitute an excessive portion of the overall portfolio, I have sold it because I see other stocks with greater opportunity, and a black swan can have a more negative effect on Blader if it should happen. However, I am not sure which stock to buy right now. I'm holding cash until the stock is in my sweet spot, and I believe can hit a home run.

My portfolio consists of 10 different stocks, each with a margin of safety (potential return) of nearly 45%, with 8% in the required rate of return. The stocks are:

| Company (Ticker symbol) | Price | Price target (realistic) | Potential return | % of the portfolio | Potential impact on portfolio |

| Pandora A/S (XCSE:PNDORA) | 979,80 | 1174,55 | 20% | 14,6% | 2,9% |

| New Wave Group AB (XSTO:NEWA B) | 95,45 | 141,26 | 48% | 12,5% | 6,0% |

| GN Store Nord A/S (XCSE:GN) | 167,05 | 215,28 | 29% | 11,3% | 3,3% |

| Taiwan Semiconductor Manufacturing Co., Ltd. (XTAI:2330) | 583,00 | 774,79 | 33% | 10,8% | 3,6% |

| Crayon Group Holding ASA (XOSL:CRAYN) | 78,60 | 122,91 | 56% | 9,8% | 5,5% |

| SP Group A/S (XCSE:SPG) | 199,60 | 293,38 | 47% | 8,3% | 3,9% |

| Fractal Gaming Group AB (XSTO:FRACTL) | 33,50 | 58,96 | 76% | 6,9% | 5,2% |

| Zaptec ASA (XOSL:ZAP) | 19,80 | 29,65 | 50% | 6,4% | 3,2% |

| Betsson AB (XSTO:BETS B) | 109,30 | 185,28 | 70% | 6,3% | 4,4% |

| Broedrene A & O Johansen A/S (XCSE:AOJ B) | 78,50 | 174,14 | 122% | 5,3% | 6,5% |

| Total | 92,1% | 44,4% |

The remaining 8%, which is not invested in stocks, is held in cash.

Compieanvey Information

Name: Fastighets AB Balder

Exchange Code: BALD B

Market Value $: 7.890,34 MM

Sector & Industry

Sector: Real Estate

Industry: Real Estate Management and Development

Price Information Price:

Price Target: 92,99 SEK

P/E: -70,92

Moat: Medium

Comments