Passive investing is a chosen strategy

Disclaimer: The analysis is the expression and assessment of investments right now. They cannot replace individual counseling. Always research and evaluate the investments you are considering based on your investment strategy, risk, and time horizon. Therefore, following the recommendations, you are responsible for any losses you may incur.

In the past decade, passive investing has become more popular among private investors, believing that buying a board passive (index) fund diversifies their portfolio. Passive funds are funds where a portfolio manager does not choose investment securities. Instead, they are automatically selected to match an index or part of the market.

Warren Buffett, the guru of investing, has approved private investors who lack investment knowledge to invest in a passive index fund, such as the US index, S&P 500. Additionally, due to the historic return, the community for private investors proponent the same investment style, with the naive belief that the investment will provide a 10-12% return annually.

Part of the popularity of the passive fund can be boiled down to the fact that active funds haven't outperformed the S&P 500. Only 1 out of 3 active management funds have nearly beaten the cheap fund of the S&P 500. Additionally, the active funds are regulated to fulfill some requirements. For instance, mutual funds need to be diversified to protect investors from ignorance. This rule forbids funds from holding stocks that constitute more than 5% of their total assets if they account for more than 25% of their overall portfolio. If the fund is a true-winner stock, which increases in price, it will constantly have to reduce its positions in the specific stock to fulfill the rules. While the fund size increases, the opportunity to buy stock with lower market capital decreases, making it harder to find winning stock simultaneously the fund needs to sell its existing winners.

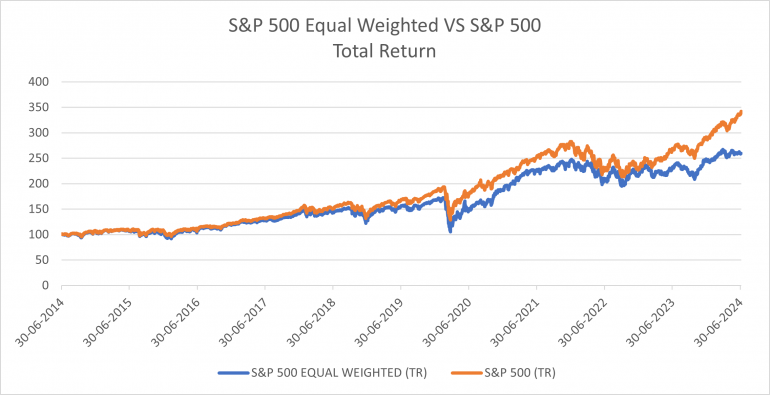

With that said, the passive fund also has some blind spots, which can result in lower returns than expected. For instance, some investors think or believe, that when they invest in a passive index fund it broadly diversifies. Among the S&P 500, the top 10 positions held around 36% of the total assets. Moreover, technology, which is the largest sector in the index, makes up 33.36% of the index. This means that the diversification isn’t as diverse as it could be. Compared to an equal-weighted S&P 500 fund top 10 positions only make up for 2%, and technology makes up for 28,2%. Historically, the S&P 500 and S&P Equal fund have had similar performances, but the spread has increased in the last couple of years. Indicate that the largest companies have increased more in value than the smaller ones, illustrated in Figure 1 below.

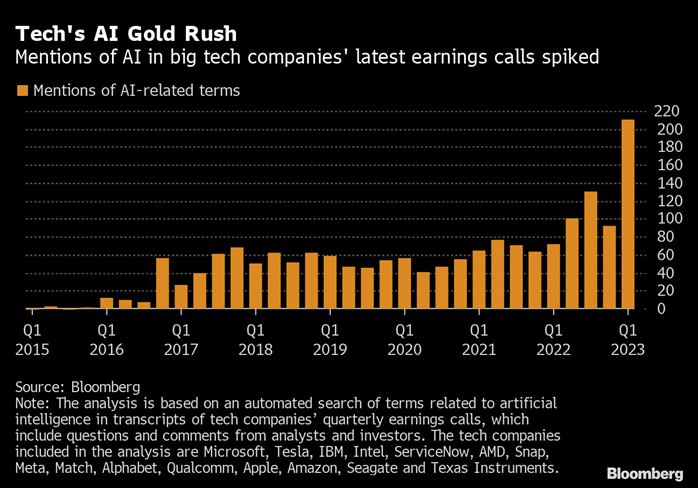

While I can’t predict the outcome of the S&P 500, figure 1 indicates higher expectations that a greater return will come from larger stocks rather than smaller stocks. In that regard, AI may have an impact on the gap between two funds that everyone tries to benefit from, and most investors and companies are looking for a piece of the cake. Stocks with high performance attract other people, searching for fortune, increasing the competition. As shown in Figure 2, AI has been mentioned in nearly 220 companies on the S&P 500 index, compared to the year 2020 there is only 60 companies have mentioned AI.

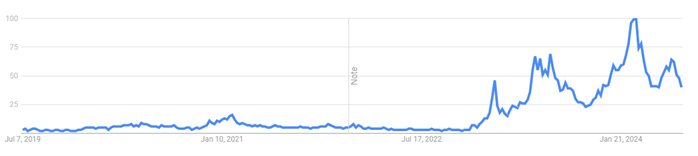

Furthermore, investors are searching for stocks related to AI. Trying to gain the same momentum as other investors, figure 3 illustrates the trend of search interest in related topics.

AI is a hot topic, and as I hear it, many believe it can result in an enormous of income in the years to come. This has also increased the valuation of the S&P 500. Currently, the S&P 500 is trading at 28,93. Looking at the top 10 companies by market capitalization in the S&P 500, it seems to explain some of the increased valuation. Most of the top 10 are traded with a P/E above 30, according to TIKR, and most of them are also related to the AI theme. Therefore, figure 4 shows the historical valuation of the top 10 stocks in the index and the rest. It is possible to see how the multiple is acting in some periods.

It seems like the top 10 are gaining a large valuation in the period, but it falls back again to a similar level as the rest. Furthermore, the rest of the S&P 500 is less volatile in valuation than the top 10. This is due to a stock in the top 10 having a larger impact on valuation than the rest of the stocks. Though I don’t know how AI will influence our society, the market believes that the winner today will be the winner tomorrow. The belief can perhaps be likened to the dot-com event in 2000, where it was the internet companies that were the main theme. Back then, it took nearly 13 years before the S&P500 came back to an all-time high again, something most investors probably don’t remember or recognize. Everything can happen, but the question is, what is most likely to happen, is something you must calculate.

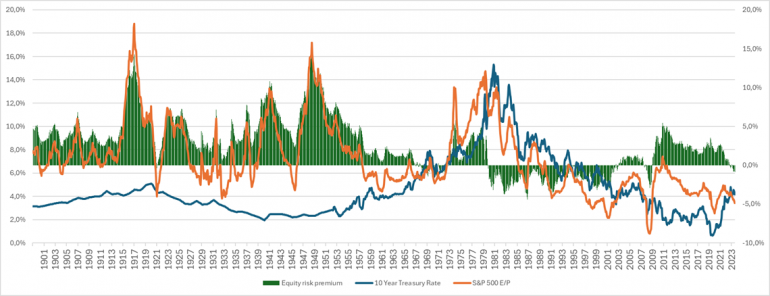

Comparing stock valuation with other stocks is unreliable for determining overall overvaluation. Here you must compare stock valuation with treasury bonds, which many professional investors use a 10-year treasury rate plus equity risk as a required minimum return. A higher interest rate can result in higher requirements on return and lower P/E. The opposite can happen if interest rates decrease.

While high valuation can be related to lower interest rates, as there were no alternative investment options other than stocks, the story may have changed. If we examine the equity premium rate, I would normally say it should be at a minimum of 2%. If you add it to the 10-year treasury rate, you should have the required rate of return. If the risk is higher, the equity premium should be higher too. The equity premium rate indicates the amount of risk the market is taking by investing in an S&P 500. Currently, the equity premium is trading at a negative value, reaching its lowest levels since 2001 and 2008.

While the equity premium was negative from 1980 to 2001, one should remember that inflation and recession were topics that could result in a high interest rate and a higher E/P. Again, this doesn’t indicate that a recession will happen, it explains the market's view on stocks. With that, we can go deeper into what return an investor should expect if everything is going well and what will happen if it isn’t. While it doesn’t conclude that stock prices are overvalued, it expresses that one of three primary events for the S&P 500 is not to be overvalued: 1. Higher EPS growth or dividend than the required return. 2. Lower interest rates 3. Rising asset prices can occur as a result of high inflation.

In regard to myself, I'm keeping my capital away from these stocks, and looking for stocks where there generally is less belief in future growth and not in stocks where most scenarios are already calculated into the price. Sure, I could be wrong. I believe in a strong strategy, and if that requires investing in the S&P 500, I’m not here to judge but to be the devil's advocate and remind you that an investment isn’t always good just because the price has increased a lot over time. You should remember that a passive investment is still an actively chosen investment. It involves fewer active transactions, but you are still betting that larger market-cap stocks will increase more in value than the rest of the market.

Comments