The core structure of value investing

A successful investor should provide a return above the average, where second-level thinking is an important tool I believe every minded investor should have. However, making it comprehensible to use is a harder task. Therefore, presents how a procedure can make it easier to understand and use when analysis of a stock is needed.

Before I start, I will mention that I believe that most of the information about the company with moderate work. I believe that the investor should turn more stones to find the best stock, and not stick too much to a single stock because it can mean that you will lose the opportunity to invest in the company if the stock price begins to rise, or other interested stocks begin to rise in price. Therefore, I think most investors should adopt the 80/20 principle. The 80/20 principle says that in almost any area, 20 percent of the input or effort produces 80 percent of the output or reward. This means also that there will be information that wouldn’t be found, creating a black swan, if something unknown happens. This means that investors should require a larger margin of safety before an acquisition is made.

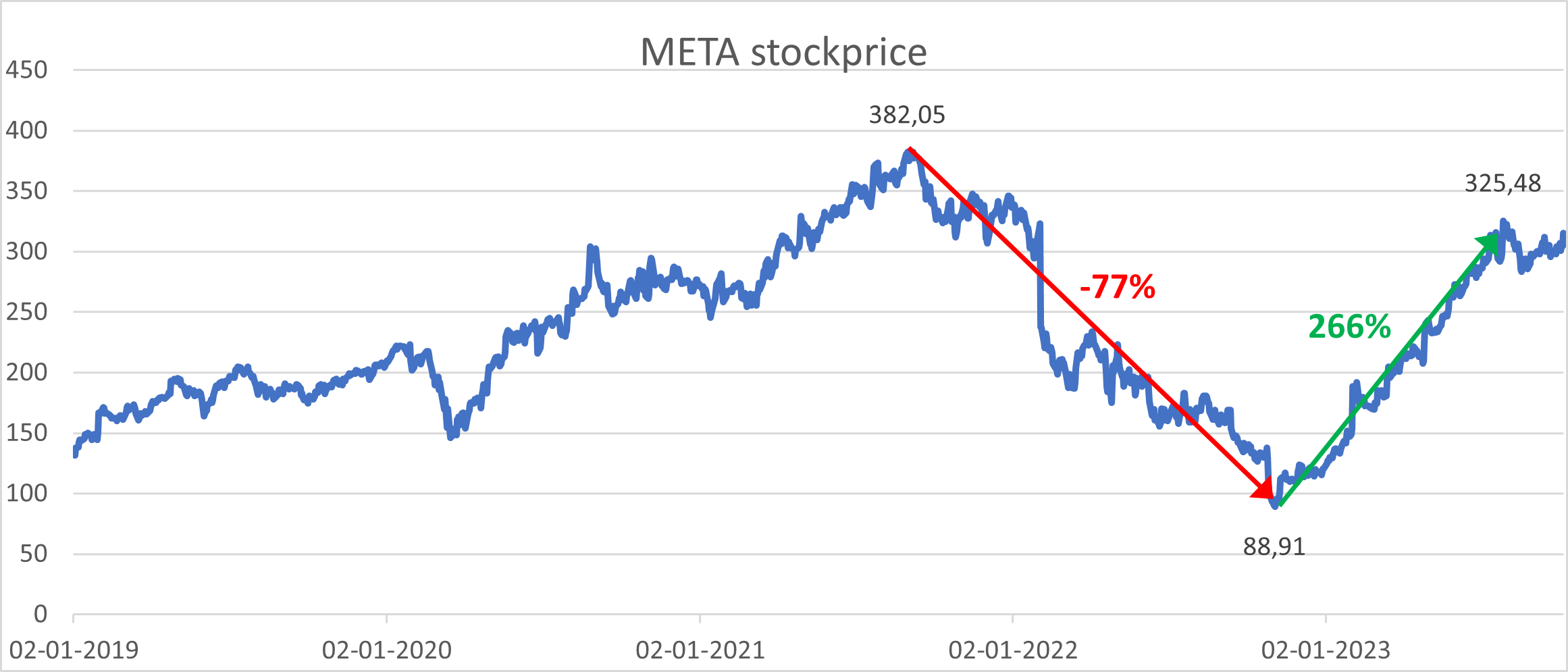

For instance, the importance of integrating the 80/20 principle could be illustrated when considering Meta as a compelling investment opportunity following a 77% decline and a P/E ratio of around 9. Devoting too much time to analyzing the investment might result in missing a significant portion, if not all, of the potential upside.

It is my belief that there are two main risks: the fundamental risk and the risk associated with the price at which you buy the stock. When assessing a company's fundamentals, it is crucial to identify factors that can impact the return. I propose prioritizing a few key elements that are essential for achieving a significant return. Having too many factors to monitor can impede the ability to thoroughly analyze all aspects. Therefore, I recommend three fundamental key points that every analysis should consider as a minimum for a comprehensive assessment:

- Growth

- Company Quality

- Management

Growth

Growth is a critical factor in the analysis. A company that consistently enhances its fundamentals over time tends to experience an increase in valuation. Consider a company growing at a rate of 10% annually with a payout ratio of around 50%; it should command a higher valuation than a company with the same payout ratio but only achieving a growth rate of approximately 5% per year.

However, predicting the exact growth rate a company can sustain over the long term is nearly impossible. Much like it is easier to assess whether a person is overweight, it's challenging to determine the precise weight. Therefore, investors should focus on analyzing the trend of the company's growth and identify factors that could contribute to increased revenue. Questions to consider include: Will the company expand its market share? Is the industry experiencing overall growth? Can the company successfully enter new geographic markets?

Company Quality

When an investor assesses the quality of a company, the key term is a sustainable competitive advantage. Historical Return on Invested Capital (ROIC) offers insights into past competitive advantages. However, relying solely on historical figures provides a backward-looking perspective. The focus of analysis should shift towards understanding how the competitive advantage will persist in the future and whether it is sustainable.

A competitive advantage is crucial because when a company earns extraordinary profits, competitors inevitably seek a share of that success. Identifying a company's competitive advantage is more of an art than a precise science. One approach involves empathizing with the customer and putting oneself in their shoes to comprehend what sets the company apart.

Another valuable tool is Michael Porter's Five Forces, which aids in understanding the sources of a company's competitive advantage and whether the company can maintain the advantage.

Management

In the same way, a football team wouldn’t win games if the team doesn’t have a competent manager, a business will not do well, if the management doesn’t do their best work in the interest of the shareholders.

Therefore, analyzing management is essential to achieve a great return on investment. A management team that doesn’t work in the interests of shareholders probably won't handle capital allocation efficiently. This refers to what a company does with all the cash it generates from its business operations. A management decision to make acquisitions without a margin of safety or to overly diversify its operations is something an investor should keep in mind when assessing the management's ability in capital allocation.

Furthermore, an investor should analyze the period of the management track record, and inspect if the management has done something the media has written down. If the management has been cheerful when everything is going well but quiet when it is going bad, an investor should question the trust in the management’s work.

Lastly, it is a positive sign when the management of a company owns shares in the company they run. This is because it indicates that the management has a vested interest in the success of the company. It shows that the management believes in the company's performance. Additionally, if the management or the company is purchasing shares, it suggests that they believe the stock is undervalued and is unlikely to fail anytime soon. Since the management is the most familiar with the company's operations, their actions in the company can provide useful insight into the company's prospects and beliefs.

Valuation

Quality isn't everything, and a company with a high-quality score can still be a risky investment because the return on a stock is correlated to the company’s fundamentals and its valuation. To value a stock, I use a model called Earning Power, developed by Danish investor Per Juul. Earning Power is unique in my perspective because it is simple and considers the two key points from which an investor can get a return – dividends and a rising stock price.

𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠𝑝𝑜wer =

An earning power above 1 suggests that the investor believes the company’s future growth will increase its value over time compared to the required rate of return. Furthermore, a company with an earnings power above 1 indicates that time is in the investor’s favor, as the valuation will not decrease year after year due to the required rate of return. By calculating earning power, it is possible to determine a fair P/E and establish a price target.

Fair P/E =

Price target =

If the overall quality of the company is low, investors should demand a larger margin of safety. Below, we can see how this valuation principle works using Pandora as an example.

|

Valuation |

|||

|

Ticker |

PNDORA |

||

|

Return requirements |

8,0% |

||

|

Current/Expected Revenue (MM) |

27.172 |

||

|

Price to sales |

3,20 |

||

|

Price to earning |

19,07 |

||

|

Current stock price |

978,40 |

||

|

Buying stock price |

728,92 |

||

|

Scenario |

Worst |

Realistic |

Optimistic |

|

Expected growth |

7,8% |

9,8% |

10,8% |

|

Expected payout rate |

30% |

30% |

30% |

|

Earning power |

1,28 |

1,53 |

1,65 |

|

Expected margin |

18,0% |

20,0% |

22,0% |

|

Expected P/E |

17,80 |

16,02 |

14,56 |

|

Expected EPS |

54,98 |

61,09 |

67,19 |

|

P/E (Fair) |

15,96 |

19,09 |

20,65 |

|

Price target (12 months) |

877 |

1.166 |

1.387 |

|

Price target in % |

20% |

60% |

90% |

|

Price target in % (current price) |

-10% |

19% |

42% |

Comments