Is there something wrong with an investment in a passive index fund today?

Disclaimer: The analysis is the expression and assessment of investments right now. They cannot replace individual counseling. Always research and evaluate the investments you are considering based on your investment strategy, risk, and time horizon. Therefore, following the recommendations, you are responsible for any losses you may incur.

An opinion often communicated by Warren Buffett when it comes to how most people should invest their money: Buy an index fund, such as the SP500 index, and the dollar cost averaging it over a long period of time. This has worked perfectly for a decade and the index has, over the past 50 years, achieved a 10,46% (including dividend) annual return. However, there is perhaps a risk for a downfall right around the corner, due to an AI-hype theme that is related to the few stocks with large weight in the index.

When a new private investor is entering the investment market, the first piece of advice they often get is that a passive index fund can be the right opportunity in most scenarios, due to its low fees. Furthermore, it is difficult, as a novice, to pick the right stocks, even active funds have a hard time beating index funds after fees measured over a period of time. Almost 81% of large-cap, active U.S. equity funds underperformed compared to their 5-year-benchmarks. Of course, not every active fund has the objective to outperform SP500. For example, some of these portfolios are focused on less volatile stocks, investing in bonds, hedging against certain outcomes, or specializing in a specific sector as Cathie Wood’s fund is doing. Therefore, some funds need to be measured differently, as their main goal is to provide a product that other investors can invest in if they believe that the product will be favorable to their portfolio. Nonetheless, in the long run, most funds haven’t been close to achieving the same return as the index investors have.

However, something important to keep in mind: SP500 has only increased since the crisis in 2007-08, and some menacing signals can result in the index falling or moving sidewise. I would like to give three of the factors why I am convinced that the index is trading at a too high level.

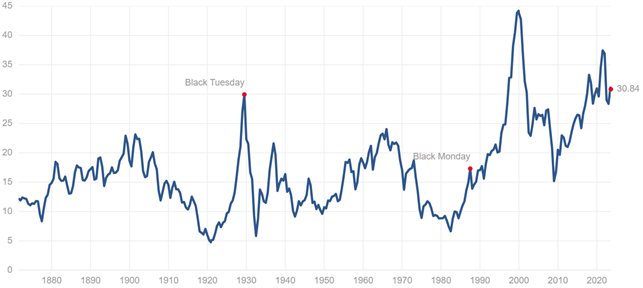

The first factor is that the SP500 price of earnings (P/E) is trading at a Shiller P/E of 30.84, which is above the average of 17.50 or a 20-year average of 26.2. The price is close to an all-time high, only surpassed in 2000 and 2021. Therefore, it can be discussed if the stock price should fall below or like 26,2, which would be a fall of 18,2%. The reason for using Shiller P/E and not the normal P/E is that Shiller P/E has been tracking the average earnings for 10 years in the companies listed on SP500 and adjusting the numbers with inflation, which makes it cyclical adjustments. So even if the companies are earning a great profit, it could indicate an unrealistic profit driven by unusually high demand, and because there hasn’t been any slowdown in the economy in the last 10 years, it can mean a market can be surprised and investors are abandoning the market which will press the stock price down. To justify the current price level the market needs to increase beyond the average, plus some more to close the gap, and the interest rate shouldn’t increase too much.

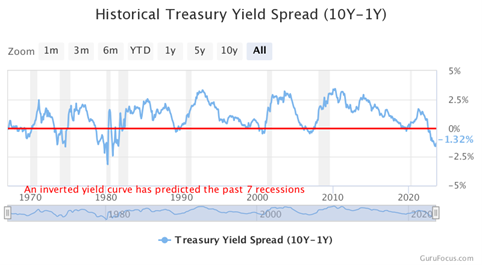

The second factor is the discussion of a possible recession. The market believes the recession is coming, which can be seen in the negative gap on the US Treasury Yield Curve. Personally, I have no idea or opinion if it is going to happen or not, but if the market believes it will, then you shouldn’t underestimate the finance industry's prediction of a possible recession. Its track record prior to the latest 7 recessions speaks for itself (marked with gray in the graph below). Of course, this result can develop differently, but the current stock price movement indicates a belief that everything is going great.

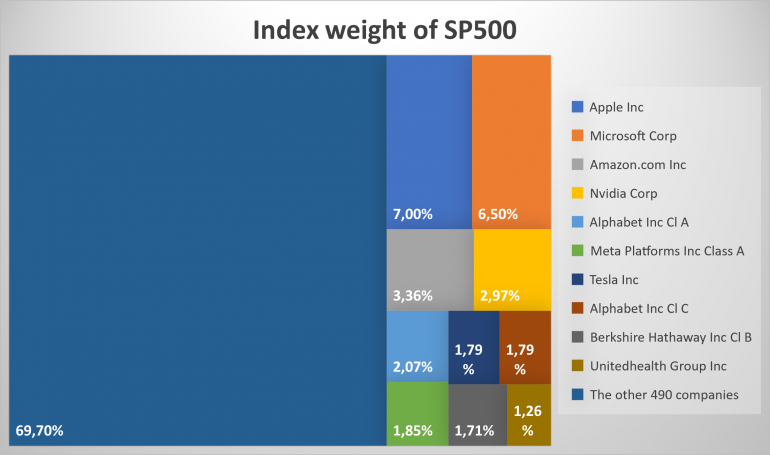

The third and last factor is that only a few stocks have given significant returns and hence have been a main factor for the increased index. 10 companies make up 30% of the index SP500, which would be acceptable if the companies were diversified. but only 2 of 10 aren’t technology and therefore there is a sector risk to be considered. Furthermore, the hot theme in 2023 is Artificial intelligence (AI), giving the tech sector an extraordinary return, where more companies are achieving a high valuation with a lot of expectations for return in the future. For example, Nvidia is trading with a P/E of 237 and a P/S of 43, and Tesla with a P/E of 71 and a P/S of 8,5, which is significantly above the normal P/E of 25 for the SP500. If these tech companies experience a downturn or similar, it affects the whole index.

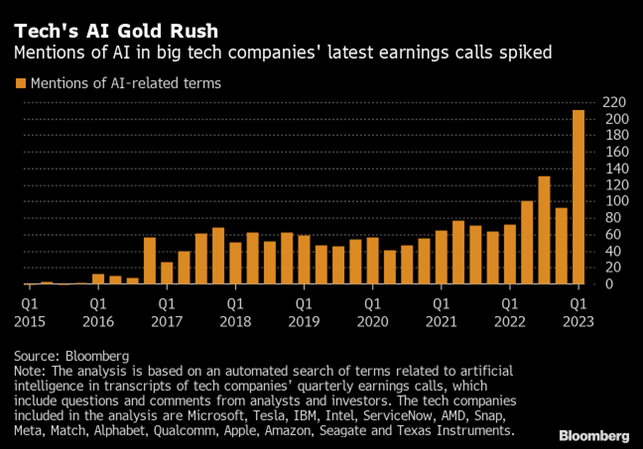

As mentioned previously, AI is a hot theme among investors, analysts, and companies. The diagram below illustrates, that the mention of AI has doubled in a few years, due to the introduction of Chat GPT in late 2022. I have no idea how big of an impact AI will have on the world, and which companies will be the biggest losers or winners if they integrate the technology. The wide coverage by the media and the discovery of ChatGPT have an effect on the stock prices of these companies. I cannot stop thinking that this euphoria for AI companies has parallels to the Dotcom bubble in the year 2000, where a similar excitement for the internet gave some companies an extremely high valuation, which proved unrealistic. The stock price plummeted, although the trend had potential for many years afterward. Again, I don’t know the potential of AI, but the valuation could be too high, so the stock price might decrease when these companies cannot deliver the return, that the market expects.

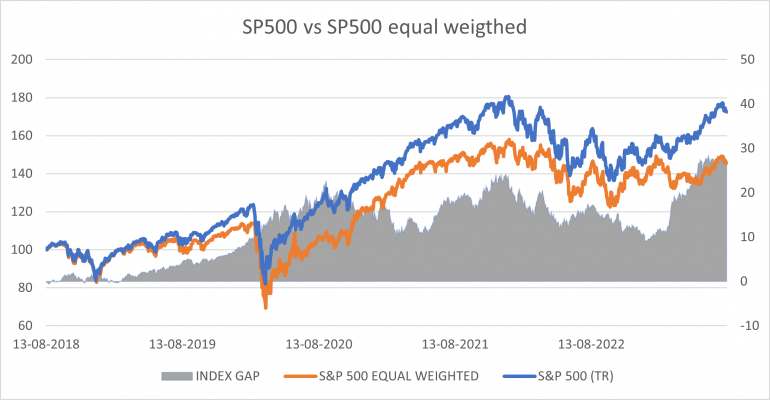

Furthermore, the biggest companies get a bigger share of the index, which means that if these companies are increasing in market cap compared to other companies in the index, their share of the index increases. Therefore, if the top companies increase in market cap, they will outperform the index if you have invested equally in every company. If the gap between a normal index and an index with equally weighted stocks is getting too wide, it can indicate a less diverse index and hence be more vulnerable if the same companies should underperform. The graph below shows how SP500 and SP500 equally weighted have performed in the last 5 years, and how the gap between the indexes is getting larger. All of this AI talk and mentions in earnings calls have driven the tech stock higher than other stocks and has made the gap between the indexes even wider than before the year 2020. After the Dotcom bubble, it took 10 years before the index got back to an all-time high.

In addition, some of these largest stocks are trying to get into each other’s markets, which can make it hard to navigate and still make the same in revenue. For example, Alphabet (Google) has launched its new phone, joining the battle of being the top phone seller, and another competitor threatening Apple’s brand again, and its market share. Microsoft is trying to retake market share from Alphabet to become people's main search website by including AI in Bing. For Meta (Facebook) it doesn’t take will not take long before Meta is losing market share to new startups with new ideas to get people's attention. Tesla has the EV- throne, but other big car manufacturer players are trying to reclaim the throne. The list is going on and all of these overtaking moving into each other niches can result in less profitable companies. If this happens, it can mean some of the companies’ stocks can fall when others will rise, making a mixed performance for the index.

In conclusion, passive index funds have previously been a good investment, compared to other active funds, where fees have a part of the blame for the underperforming against the benchmark. However, the index can perhaps face a downturn because the price of the index is higher than average, there is the risk of a recession, and the AI theme may lose its momentum and pull the market down. All of these factors don’t mean that the market will fall, but I believe it can be a risk, and as Warren Buffett says: Rule number one, never lose money. Rule number two never forget rule number one.

Comments