Are the luxury-related companies in a bobble?

The analysis is the expression and assessment of investments right now. They cannot replace individual counseling. Always research and evaluate the investments you are considering based on your investment strategy, risk, and time horizon. Therefore, following the recommendations, you are responsible for any losses you may incur.

In the realm of investments, those related to luxury companies have yielded considerable returns, as exemplified by LVMH, a notable player selling products like Louis Vuitton, Christian Dior, and Celine, boasting an impressive annual return of 20% over the last decade. The luxury sector has become an established alternative investment, particularly resilient during tough economic times, notably in recessions. The underlying thesis is that these brands symbolize the wealthiest segment of society, acting as status symbols for buyers and reflecting individual prosperity. For instance, a Birkin bag was sold for $450,000 in 2022, with no option to purchase it through their website or store, emphasizing the sustained high demand for luxury goods.

It's important to note, however, that not every luxury sale is exclusively tied to the richest echelon of society, and this raises questions about the broader effects.

I don't intend to predict the future of the industry; the purpose of this article is to illustrate that a luxury company doesn't guarantee short-term returns or immunity from economic downturns. While I acknowledge that luxury companies possess a certain level of competitive power or moat against suppliers or customers, the industry remains cyclical. Some stocks are trading with a P/E between 25-30, indicating a high belief from the market that these companies will continue to grow for many years.

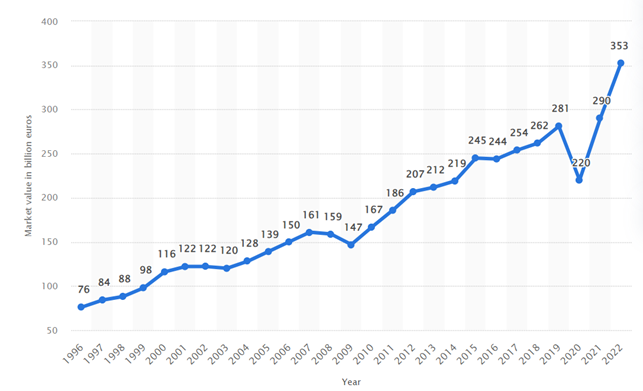

Historically, luxury investments have proven wise choices, and the industry experienced a remarkable increase in market value in 2021 and 2022, driven primarily by heightened demand and increased wealth among the population. The chart below depicts the market value of the luxury industry in billion Euros.

Another contributing factor to the increase in the luxury industry's value could be linked to speculation in cryptocurrency. The combination of low-interest rates and an influx of new private investors, whom I prefer to term speculators, has amplified the demand for luxury goods. These investors purchase items and hold them, anticipating resale at a higher price. While cryptocurrencies, particularly Bitcoin, have experienced a significant drop since their peak in late 2021, the speculated bubble has not yet impacted companies in the luxury industry. The extent to which this type of buying contributes to total revenue is uncertain, but a decrease in demand could potentially impact industry revenue or valuation.

Additionally, the increased presence of individuals on social media flaunting their luxury items and showcasing the latest fashion trends has become noteworthy. This market segment doesn't necessarily belong to the wealthiest part of society, but the use of these items makes them relevant within their channels or friend groups. These influencers have continued to grow their audience by showcasing the latest models or hottest items. I categorize influencers marked by luxury items into two segments.

The first segment consists of influencers showcasing their lifestyle, attracting a crowd interested in following their lead. This segment can generate revenue through marketing other products, participating in shows, or featuring commercials on their channels. However, I see this segment as highly volatile, following demand generated by marketing from other companies, and these influencers face substantial competition. If demand decreases, it can create a bubble of interest in this type of influence.

The second segment comprises those who view luxury items as a good investment. In my opinion, considering luxury items as an investment is akin to buying gold or cryptocurrency—pure speculation. Historical price data may offer hope of buying items and selling them at a higher price, but recent data show a decline in prices for some items. The chart below illustrates the index prices of Rolex and Patek, indicating a decline from their 2022 peak to the lowest point in two years, representing a fall of over 50%.

In conclusion, historical instances such as The Dutch Tulip, The Dot-com, and The U.S. Housing Bubble serve as reminders that speculated assets have risen and subsequently experienced significant declines. The luxury industry appears to be entering a phase of increased volatility, driven by the growing opportunity for the middle class to purchase more luxury items. Influencers play a role in stimulating demand by promoting the latest items, and some individuals see luxury items as a potential investment for future returns.

However, potential challenges loom. A higher interest rate could act as a deterrent for the middle class to continue buying luxury items. Furthermore, the high stock prices in the industry suggest elevated growth expectations with limited room for profit increase. While these factors don't guarantee a downturn, they pose risks that should be carefully considered when investing in this industry. Only time will reveal the industry's fate.

Comments