Kamux - Bargain Deal on Used Car Dealer, Yet Quality Concerns

Disclaimer: The analysis is the expression and assessment of investments right now. They cannot replace individual counselling. Always research and evaluate the investments you are considering based on your investment strategy, risk, and time horizon. Therefore, following the recommendations, you are responsible for any losses you may incur.

Info about the company:

Kamux Oyj, together with its subsidiaries, wholesales and retails used cars in Finland, Sweden, and Germany. The company also offers financing and insurance products, sells used cars at auctions, and provides various integrated services to consumer and corporate customers. In addition, it offers Kamux Plus, which extends liability for defects. The company provides its services through showrooms and digital channels.

Geographical sales: Finland (69,65%), Sweden (28,28%), Germany (10,19%).

Moat: None (→)

Prologue

The car industry has seen low demand, resulting in lower sales and gross margins. The CEO of Kamux, Tapio Pajuharju, said that "the last quarter of 2024 was extremely challenging for Kamux" and that "a growing number of consumers sell their cars via commercial platforms." All this means that the demand for cars has decreased while the variety of customer options has increased. The market affordability has shifted to customers choosing more affordable combustion engine cars.

However, the market has not been the only source of headwinds. Internal issues have also contributed to the stock's downturn. Kamux is trying to enter several geographic markets, meaning the margin is negative or near zero in Sweden and Germany. Thus, maintaining higher volume is essential for securing a better margin than competitors to achieve equivalent profits to their Finland segment.

Overall, the market headwind and internal issues have made it extremely difficult for Kamux to make a turnaround. Kamux has downgraded its expectations twice in 2024, and guidance for 2025 is to improve margin. However, if it is possible to maintain their long-term target of 4% and increase revenue, the stock could be extraordinarily cheap compared to other stocks.

Growth - Quality score 1 out of 5

Taxes influence when and what people choose to buy, and exchanging cars is crucial for customers seeking value for money. The car remains the preferred method of transportation for most people, as rising living standards allow for purchasing a first or second vehicle. Thus, for some individuals, a car is essential for transportation. If their previous vehicle is out of order, they must find a new one, regardless of the circumstances. This would also mean that used car dealers are less cyclical than new car dealers because customers will be down-traded from new to used if the first best choice isn't possible.

Kamux operates in a cyclical industry and should be highly correlated to the car industry. It is typical finance with debt, making interest rates important for customers. However, a higher interest rate will also result in customers switching from buying new, more expensive cars to used cars. Cars are usually utilized in areas where no other transportation option is viable, indicating that urbanization negatively impacts the car industry due to a decreased need for personal vehicles. Additionally, regulations can influence a customer's purchase of a new or used car. In the long run, Kamux should fear self-driving vehicles. If this decreases car ownership and increases taxi carpools, the total number of used cars will decline.

Business - Quality score 2 out of 5

The most significant advantage KAMUX can achieve is through the network effect, which is evident in Finland, where the margin is significantly higher than in other markets where they operate. In the segment KAMUX operates in, volume is crucial, and higher volume usually leads to higher margins if the company sells cars at a profit. According to Kamux, it is the market leader in Finland, which means the services it provides are effective in certain countries.

Some franchise auto dealers will try to replicate successful companies with their stand-alone used-vehicle stores, and startups are also competing. The competition is tough, and there are already many competitors, none of whom hold a significant market share. Combined with Kamux's lack of a moat, various factors can impact Kamux's revenue and profit. C2C platforms competing with Kamux don’t have physical assets like cars and showrooms. They are popular because sellers keep most of the sale price instead of sharing with an intermediary. Buying a car is expensive, so Kamux customers are tough negotiators, limiting Kamux’s pricing power.

Management - Quality score 3 out of 5

There is significant insider ownership, with founder Juha Kalliokoski owning approximately 13,42% of the outstanding shares. This means he has substantial voting power regarding the company's direction and is part of the board. Moreover, insiders comprise 5% if Kalliokoski is excluded. The management has expressed their aim to gain a competitive edge through operational efficiency and customer commitment. Customer trust is important because the industry has gained a bad reputation for trustworthiness. Additionally, they have suggested that they prioritize profitability over growth.

Significant employee turnover has resulted in a disadvantage for developing a sustainable competitive edge in any business. This could suggest that the former CEO and founder weren't particularly skillful with people, that the company expanded so rapidly that previous roles required new skills, or that there were underlying issues. Additionally, the former CEO spent only a few years at Kamux, raising concerns about job qualifications (difficult company to manage) or hinting at potential internal issues. Current management hasn't shown results due to the short time that they have been at KAMUX. They aim to improve employee turnover and eNPS score. Furthermore, the management has recently revised their expectations for the entire year, questioning whether their target is achievable.

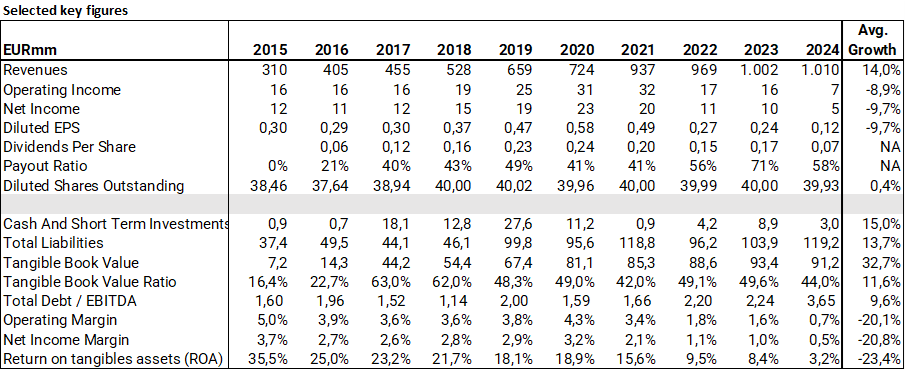

Financial

Looking at the key ratios in the financial statements, the margin and sales growth have been under pressure for some time. The leverage level seems healthy for now, and net debt to EBITDA is below 3,5 during economic headwinds. Moreover, the relationship between tangible assets and liabilities allows for reduced income in the years ahead. While the payout ratio has varied, the management has expressed a target of 25% in a normalized situation, which indicates that the rest of the capital will be used to expand the business. Additionally, Kamux has not made any noticeable acquisitions. Historically, Kamux has maintained a margin of around 3%, a factor in the valuation process. Furthermore, the operating margin in Finland has traditionally been around 4% to 6.8%, while other markets have hovered close to zero or been negative. This suggests that Kamux could improve their margin by improving operations in Germany and Sweden or selling off parts of the business, which may hurt revenue but ultimately increase the margin.

Valuation

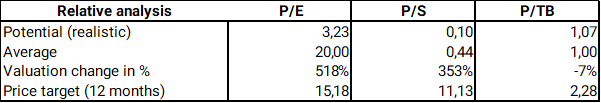

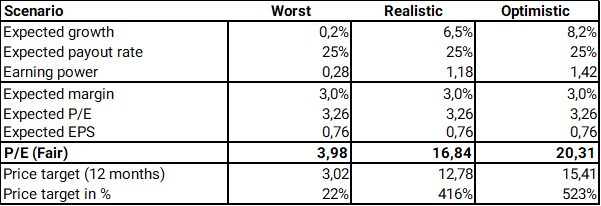

Several outputs can impact the valuation estimation of the company. Its low-quality factors make it hard to predict whether Kamux can overcome the challenges in time, and the margin of safety should also be reflected in the valuation. However, if the management target of 4% adjusted EBIT is achieved, the income margin is estimated to be around 3%, which gives a P/E of 3,26 on the current revenue. This suggests that the market does not have confidence in Kamux's growth prospects or its ability to restore margins to previous levels. However, this could allow Kamux to surprise the market, potentially enabling the P/E ratio to return to the average level of 20. However, this multiple may be irrelevant, considering that Kamux has a high multiple when unprofitable. From 2020 to 2021, during a time of booming sales, the P/E ratio was quite tempting, but the margin was unrealistic.

Therefore, the Price-to-sales (P/S) should be a better ratio to illustrate the market's belief in growth and/or profitability. Here, Kamux P/S is traded at 0,10, but the average 10-year P/S is around 0,44.

Additionally, the Price/Tangible Book Value (P/TB) is trading at 1.07, indicating that the stock shouldn’t drop below a P/TB of 1, establishing a lower boundary. It would be unreasonable for Kamux to trade below this ratio if it continues to report positive earnings. However, investors should be cautious because assets like cars are usually purchased at higher prices when the economy is strong. When the economy slows down, these cars might be bought at inflated prices, and their value may not match the accounting figures.

Kamux has grown by 14% annually over the past 10 years, and its target of 1.500 million EUR should be realistic to achieve by 2030, representing an annual growth of around 6,5%. If this can be achieved with a 25% payout ratio and a 3% net income margin, the realistic P/E would be 16,84, giving a potential price target of 12,78 EUR. In the optimistic scenario, the average growth rate has changed to 8,2%. This has resulted in a calculated P/E of 20,31 and a potential price target of 15,41 EUR.

In the worst-case scenario, Kamux is estimated to abandon Sweden and Germany and subsequently focus solely on operations in Finland. This means the average growth will be close to zero but will maintain the same margin as the historic level of 3%. In this scenario, the price target will be 3,98.

Additionally, if Kamux achieves an income margin of 3% and a payout ratio of 25%, the dividend yield is around 7,7%. However, the dividend yield can fluctuate depending on the margin.

Overall, the estimation indicates significant potential, where many factors must go wrong before the investment becomes a loss.

Conclusion

To round this up, Kamux's strategy focuses on placing the customer at the core of all activities and improving operational efficiency and profitable growth. Here, they aim to accelerate organic growth with acquisitions and strategic partnerships. Kamux's financial target is to increase revenue to 1.500 MM EUR and an adj. The EBIT margin is 4%, but there is no date to achieve this. The EBIT margin in Finland is, in 2023, at 4%, having previously ranged between 6% and 7%. This indicates that the other geographic segment yields a low or negative margin. Management announced at least 25% dividends of net profits.

Kamux Oyj operates in a challenging environment marked by low demand for used cars and internal hurdles as it expands into new markets. With a significant portion of their sales concentrated in Finland, the company faces intense competition from traditional dealers and C2C platforms, further complicating their margin recovery efforts. Although management demonstrates a commitment to improving operational efficiency and customer trust, the lack of a competitive moat and the cyclical nature of the car industry dampen long-term growth prospects.

Another time-related question could also be whether their margin will return to normal. As it is right now, it doesn’t seem like it will happen any time soon, and waiting for something that won’t happen can result in opportunity costs.

Catalyst

- Yearly cars sold: 100.000 (unknown time target)

- Revenue 1.500 MM EUR (unknown time target)

- Adj EBIT margin 4% (unknown time target)

- Customer score (NPS) 60

- Employer Score (eNPS) 40

- Payout ratio of 25%

Company Information

Name: Kamux Oyj

Exchange Code: KAMUX

Market Value $: 104,12 MM Dollars

Sector & Industry

Sector: Consumer discretionary

Industry: Specialty Retail

Price Information Price:

Price Target: 12,4

P/E: 16,84

Moat: None

Source: TIKR (financial statement), Kamux’s financial reports, and Capital Markets Day.

Comments