House leverage could be an issue

Disclaimer: The analysis is the expression and assessment of investments right now. They cannot replace individual counseling. Always research and evaluate the investments you are considering based on your investment strategy, risk, and time horizon. Therefore, following the recommendations, you are responsible for any losses you may incur.

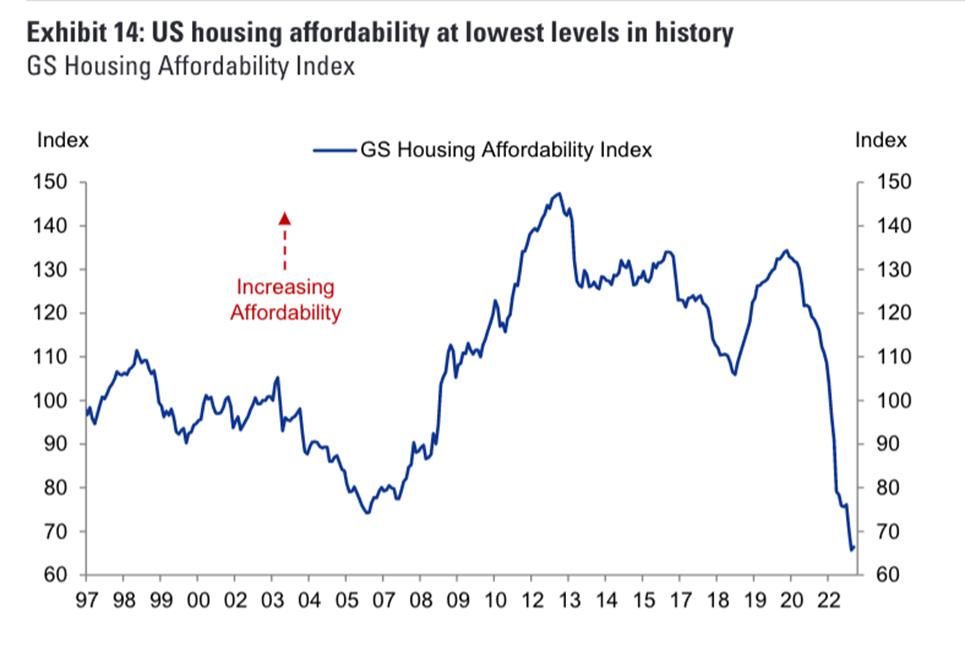

Historically, purchasing a house has consistently been affordable for buyers in the US. However, today, the narrative has shifted significantly. This shift could have a notable impact on purchasing power, especially if a black swan event were to occur. While buying a house has traditionally been a lucrative investment for the average homeowner, the current trend suggests that this pattern could be coming to an end. The data is from the US, but I would say that the trend is similar to countries as well.

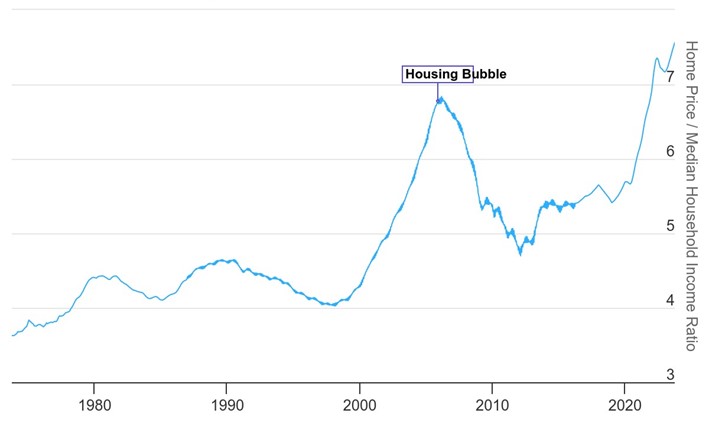

The key question is why it can happen. Examining how homeowners have purchased houses provides a clear explanation—it's leverage. Comparing the median house price to annual household income reveals the significant impact of leverage. Historically, the average cost of a house in the US has been around 5 times the yearly household income, but today, it exceeds 7.5.

The reason why the ratio is higher than the bubble in 2006 is due to the interest rate, which has fallen from an all-time high in 1981 to nearly 0% in 2020. This makes it possible to borrow more without a higher paying more for the loan. This means that house owners have a harder time paying back their loans if the housing price or income is increasing. This doesn't mean that the housing market is a bubble, but only that there is a greater risk of default than previously. Overall, the main reasons why house prices should increase are; interest rate, inflation, and economic growth in the country.

However, if US housing affordability is at its lowest why aren't the house price dropping? The reasoning is that people there is living in a house don't want to move due to higher interest rates, and newcomers can afford houses due to interest rates. Therefore, the housing market can be seen as frozen, where buyers can't afford to enter and sellers can afford to sell without a loss. A real Mexican standoff, where everybody is waiting for something to get better. What would happen I have no idea, but if buyers should afford to buy, it could happen by lowering the housing price or increasing wealth. In addition, another topic could be what will happen if the homeowner is forced to sell. That could affect house prices to a level where the demand can reach. However, only the future will tell.

The reason the ratio is higher than the 2006 bubble is attributed to the interest rate, which has dropped from an all-time high in 1981 to nearly 0% in 2020. This allows for more borrowing without incurring higher loan costs. Consequently, homeowners face challenges repaying loans if housing prices or incomes don’t rise. The main factors influencing house price increases are interest rates, inflation, and overall economic growth in the country.

Despite the fact that US housing affordability is at its lowest, why aren't house prices dropping? The explanation lies in people currently living in houses being hesitant to move due to higher interest rates, while newcomers can afford houses due to higher interest rates. Consequently, the housing market can be perceived as frozen. Buyers struggle to enter, and sellers can afford to sell without incurring losses. It resembles a Mexican standoff, where everyone is waiting for an improvement. What that improvement might be is uncertain, but if buyers are to afford homes, it may entail either lowering housing prices or increasing wealth. Another aspect to consider is the potential impact on house prices if homeowners are compelled to sell, affecting the demand in the market. However, only the future will reveal the outcome.

Another factor to consider is that we live in a world where investing in a house is often perceived as the safest and most stable investment. Despite the significant liabilities involved in purchasing a house, some do so without intending to pay it off. In the event of a recession or similar economic downturn, there could be a decline in purchasing power if homeowners are forced to sell.

Comments