Dollar General: A turnaround case

Disclaimer: The analysis is the expression and assessment of investments right now. They cannot replace individual counseling. Always research and evaluate the investments you are considering based on your investment strategy, risk, and time horizon. Therefore, following the recommendations, you are responsible for any losses you may incur.

Country: America

About the company: Dollar General Corporation (DG) is a discount retailer that operates across the southern, southwestern, midwestern, and eastern regions of the United States. The company is focusing on a low-cost store for customers with lower financial strength. The company offers a wide range of merchandise products such as consumable goods, hygiene products, and personal care items, which account for 78% of its total sales. Additionally, it sells seasonal products, household items, clothing, and accessories, which make up the remaining 22% of total sales. The company has currently 19,104 stores in 47 states. The company was founded in 1939 under the name J.L. Turner & Son, Inc. and later changed its name to Dollar General Corporation in 1968. The company headquarters are located in Goodlettsville, Tennessee.

Competitors: Dollar Tree, Costco Wholehouse, Target Corporation, Walmart.

Geographical sales: 100% America

Moat: Medium (→↓)

Prologue

On the 29th of August, the stock price dropped by 30% following a disappointing guide for the whole year. It was mentioned in the quarterly report, which grabbed the headlines.

- Net sales growth in the range of approximately 4.7% to 5.3%, compared to its previous expectation of approximately 6.0% to 6.7%

- Same-store sales growth in the range of approximately 1.0% to 1.6%, compared to its previous expectation in the range of 2.0% to 2.7%

- Diluted EPS in the range of approximately $5.50 to $6.20, compared to its previous expectation of approximately $6.80 to $7.55

This indicated that the management didn’t have the turnaround under control as investors thought they had. DG continues to be negatively affected by weak spending capacity from its core low-income customer base. Management estimates that more than half of its sales come from shoppers with a household income of less than $35,000.

Growth - Quality score 2 out of 5

According to the latest statistics as of September 2023, more than 60% of Americans are living paycheck to paycheck. Poverty is a major challenge in certain parts of America. As a result, DG is the primary shopping store, which allows customers to save some money. Due to the location of poor citizens, it is not profitable for other stores such as Walmart and Costco to operate in these areas, but for DG, it is profitable. Additionally, the products are essential for customers, which means that sales will be steady and less volatile. In addition, DG only operates in the USA, which opens up the possibility of expansion into Mexico or other similar countries.

DG is facing a major issue as it is not perceived as a desirable workplace. Most of the employees working there apply only because they cannot find employment elsewhere. This results in a low employee retention rate of around 2.4 years, which means that the company has to constantly recruit new staff. According to Glassdoor, which is a website that scores a company by its staff, DG has an overall score of 2.7 out of 5, which is considered low. This suggests that the company may have a low ESG score and may struggle to attract new employees. The median annual income for DG employees is $17,000. Due to its presence in low-cost areas, there may be an increased risk of theft, which could negatively impact both the staff and customers' experiences.

Business - Quality score 3 out of 5

In some areas, DG has a monopoly- or duopoly-like status due to a lack of alternative stores and low prices, making it difficult for newcomers to enter the market. Alternative grocery e-commerce won't be available in DG areas due to the large distance between cities and low-income communities. Furthermore, the network gives DG the advantage of being scale-driven in smaller stores. DG's stores are much smaller than Target and Walmart, allowing them to be closer to customers and spend less on expansion. About 80% of Dollar General's sales occur in small communities, giving the company control over local markets. Additionally, DG has a limited selection that gives them more buying power with suppliers and has close to no fresh products, such as vegetables, making it easier to avoid food waste.

Switching costs are virtually nonexistent, making the retail industry inherently cutthroat. Dollar General faces competition from mass discounters, grocery, drug, and convenience stores, which could impact its market in the USA. Furthermore, the quick ratio has been historically very low, which can cause some low-term challenges, but this ratio is DG’s peers. The dollar store footprint looks crowded today. Dollar General, Dollar Tree, and Family Dollar account for over 37,000 storefronts. DG business isn't proven to work outside of the USA. This can mean that profit wouldn't be as attractive outside the USA as inside the USA.

Management - Quality score 3 out of 5

The current CEO of the organization, Todd Vasos, has been serving in this position since October 2023. He has been a member of the Board of Directors since June 2015 but has been associated with the organization since 2008. It's worth noting that he had previously served as our CEO from June 2015 to November 2022 before transitioning to Senior Advisor. He retired in April 2023 but then returned as CEO due to some structural problems that the former CEO, Jeffery Owen, couldn't handle. Historically, DG has made very few acquisitions, and instead repurchased shares, and paid dividends. However, in the current movement, the shares buyback program is paused, and the debt situation has improved.

Todd Vasos is currently 59 years old and has been managing DG for some time now. However, he still needs to find a replacement as he plans to step down from his role. This means that there is some uncertainty about the future of the company's management. It is also unclear whether any of his colleagues are suitable candidates to take over as CEO. Additionally, insiders only own 0.25% of the company's shares, which means that they don't have much control over the company. Therefore, the overall ownership is weak, resulting in no skin in the game. As a result, they are likely to do what the shareholders want. Focusing on the short-term gain instead of the long-term value-creation.

Financial

DG's operations have low volatile sales and are considered a non-cyclical company. Although the growth rate is expected to be lower, I believe that the company can maintain its operating margin (around 8%). Furthermore, DG hasn't, in the recent 10 years, had a decrease in sales in a single year. The retail market is highly competitive, and well-positioned stores like Walmart may try to restructure to gain market share against DG. However, due to DG's niche-placed stores, it is unlikely that Walmart, or any other competitor, could gain significant market share overnight. Furthermore, the financial balance is healthy and does not seem to pose any short-term challenges.

|

Selected key figures |

|||||||||||

|

USDmm |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

Avg. Growth |

|

Revenues |

18.910 |

20.369 |

21.987 |

23.471 |

25.625 |

27.754 |

33.747 |

34.220 |

37.845 |

38.692 |

8,3% |

|

Operating Income |

1.785 |

1.946 |

2.070 |

2.016 |

2.120 |

2.337 |

3.557 |

3.223 |

3.330 |

2.453 |

3,6% |

|

Net Income |

1.065 |

1.165 |

1.251 |

1.539 |

1.589 |

1.713 |

2.655 |

2.399 |

2.416 |

1.661 |

5,1% |

|

Diluted EPS |

3,49 |

3,95 |

4,43 |

5,63 |

5,97 |

6,64 |

10,62 |

10,17 |

10,68 |

7,55 |

9,0% |

|

Dividends Per Share |

|

0,88 |

1,00 |

1,04 |

1,16 |

1,28 |

1,44 |

1,68 |

2,20 |

2,36 |

NA |

|

Payout Ratio |

0% |

22% |

23% |

18% |

19% |

19% |

14% |

17% |

21% |

31% |

NA |

|

Diluted Shares Outstanding |

305,68 |

295,21 |

282,26 |

273,36 |

266,11 |

258,05 |

250,08 |

235,81 |

226,30 |

219,94 |

-3,6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Total |

11.209 |

11.258 |

11.672 |

12.517 |

13.204 |

22.825 |

25.863 |

26.327 |

29.083 |

30.796 |

11,9% |

|

Total Equity |

5.710 |

5.378 |

5.406 |

6.126 |

6.417 |

6.703 |

6.661 |

6.262 |

5.542 |

6.749 |

1,9% |

|

Equity Ratio |

50,9% |

47,8% |

46,3% |

48,9% |

48,6% |

29,4% |

25,8% |

23,8% |

19,1% |

21,9% |

-8,9% |

|

Total Debt / EBITDA |

1,28 |

1,29 |

1,31 |

1,24 |

1,11 |

2,69 |

2,35 |

2,53 |

2,96 |

3,34 |

11,2% |

|

Operating Margin |

9,4% |

9,6% |

9,4% |

8,6% |

8,3% |

8,4% |

10,5% |

9,4% |

8,8% |

6,3% |

-4,3% |

|

Net Income Margin |

5,6% |

5,7% |

5,7% |

6,6% |

6,2% |

6,2% |

7,9% |

7,0% |

6,4% |

4,3% |

-3,0% |

|

Return on investment (ROI)* |

15,9% |

17,3% |

17,7% |

16,1% |

16,1% |

10,2% |

13,8% |

12,2% |

11,5% |

8,0% |

-7,4% |

*The decrease in ROI in 2018 and 2019 happened because of new financial rules, that provide companies to keep track of capital leases (IFRS 16)

Valuation

Looking at the three cases, I have estimated a potential return of around 100% at the current price, which can be seen in the table below. In that valuation, several factors need to be achieved to fulfill the valuation. First of all, DG needs to retain its margin to the average margin. Secondly, it needs to repurchase shares again. At the top, DG spent 2.748 million dollars on share buybacks, which will result in a negative net change in cash. Without increasing debt, I find it unrealistic to continue. However, less spending on share buyback is also an improvement. Spending 800 MM dollars will result in a decrease in the market cap of 4,4% at the current level, which I don’t see as an unrealistic amount. Furthermore, the dividend shall continue with the same 20% payout ratio. Third and last, the revenue needs to increase. In the realistic case, I have estimated a 3% annual rate, and including the shares buyback, the estimated total revenue per share will increase by around 6,5% annually in the long term. If they can or make less shares buyback the worst case reflects that, and only 4% annual growth is more realistic. A fair P/E of around 16 is considered a large margin of safety, due to the expected P/E of 7,86. Therefore, considering the risk and potential return, I see the valuation as a good bet.

|

DOLLAR GENERAL CORPORATION (XNYS:DG) |

|||

|

Return requirements |

7,0% |

||

|

Current/Expected Revenue (MM) |

38.692 |

||

|

Price to sales |

0,47 |

||

|

Price to earning |

12,89 |

||

|

Dividend Yield |

2,5% |

||

|

Current stock price |

82,97 |

||

|

Buying stock price |

|||

|

Scenario |

Worst |

Realistic |

Optimistic |

|

Expected growth |

4,0% |

6,5% |

6,7% |

|

Expected payout rate |

20% |

20% |

20% |

|

Earning power |

0,77 |

1,16 |

|

|

Expected margin |

3,0% |

6,0% |

7% |

|

Expected P/E |

15,72 |

6,74 |

|

|

Expected EPS |

5,28 |

10,56 |

12,32 |

|

P/E (Fair) |

11,02 |

16,55 |

|

|

Price target (12 months) |

58 |

204 |

|

|

Price target in % |

-32% |

139% |

|

|

Price target in % (current price) |

-30% |

105% |

146% |

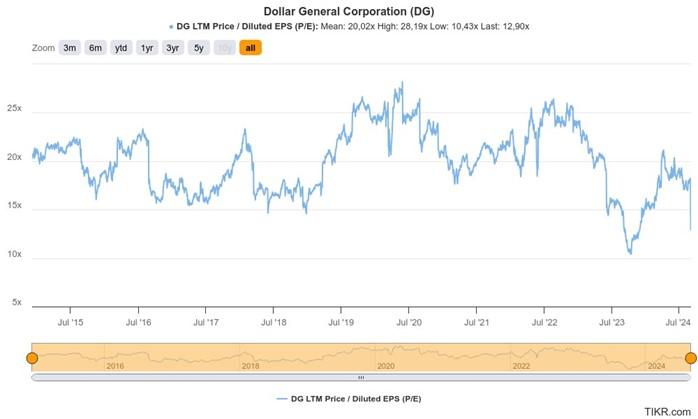

Analyzing the historical P/E for DG it has been around 20 on average, which is a higher P/E than the P/E I have valued the company. The higher P/E reflects a market that hasn’t had the same concern about DG growth and profitability. Therefore, I don’t see the company retaining the same valuation by the market as previously unless DG is showing a new growth rate, which I haven’t considered either. If it does maintain a P/E of 20 there will be an upside of 154% on the current level and a price target of 211 dollars.

Conclusion

Overall, the company is getting some headwinds, but a potential turnaround in operating margin to its average and continued increasing margin can result in a significant return. In reverse, the margin is already low, and the market doesn’t believe that DG can get back to its previous margin, meaning it will continue to be at its current level. The KPIs I will keep an eye on in the coming financial reports are:

- Maintain gross margin (30%)

- Retain previous operating margin (Higher profitable in stores)

- Increasing like-for-like sales (Same-store sales growth)

- Repurchase shares buyback when the operating margin is maintained at the previous level.

Company Information

Name: Dollar General Corporation

Exchange Code: DG

Market Value $: 18.246,36

Sector & Industry

Sector: Consumer Defensive

Industry: Discount Stores

Price Information Price:

Price Target: 170

Excepted P/E: 7,86

Moat: Medium

Comments